The Signicat Blog

-

Blog

What brown M&Ms can teach you about contracts

-

Blog

Kubernetes: Your Sidecar configurations are drifting

-

Blog

The onboarding advantage: how operational efficiency boosts conversion

-

Blog

Empowering Women in Tech: Signicat's Commitment to Equality and Diversity

-

Blog

Building trust into every signature

-

Blog

Stand up to the scamdemic: how Signicat helped reduce fraud costs and fraud rate by 75%

-

Blog

Test, buy and deploy digital identity solutions in days, not weeks (with no meetings)

-

Blog

From Vision Towards Reality: The Journey of Establishing a European Digital Identity

-

Report

New European Identity - eIDAS 2.0

-

Blog

First 5 experiences on the journey to build a data-driven company

-

Blog

Planned Difference: Consciously diverging from standards

-

Blog

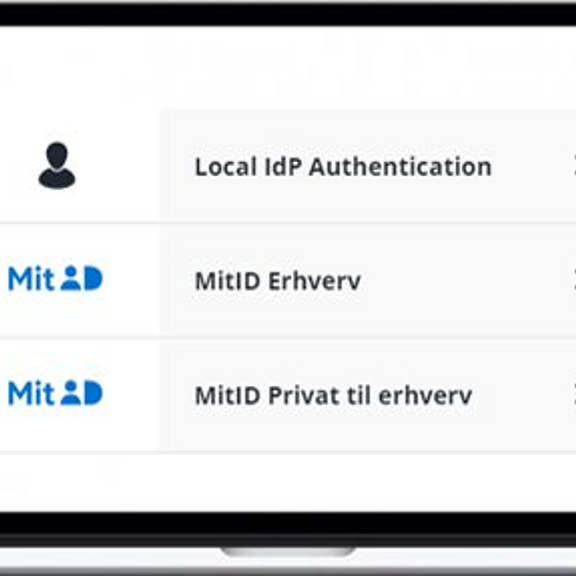

Signicat now offers Local IdP in addition to MitID Business as a login and signing option

-

Blog

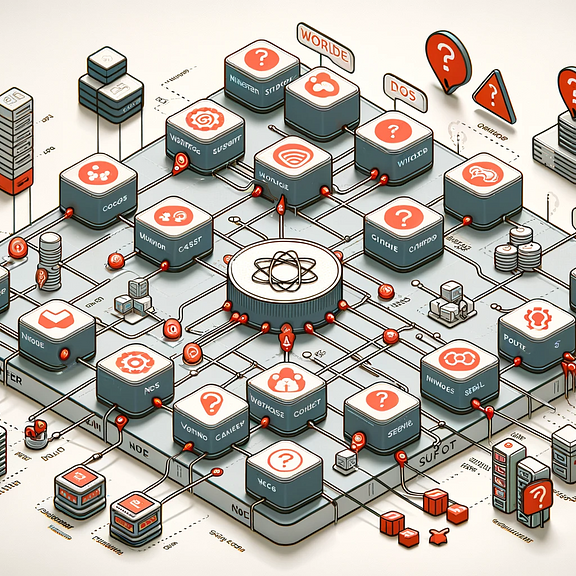

Kubernetes: Don't use NodeLocal DNSCache on GKE (without Cloud DNS)

-

Blog

Forrester Total Economic Impact™: Discover the ROI of Signicat

-

Blog

Digital identity wallets: exploring benefits and luxury traps

-

Blog

Signed, sealed..but maybe not compliant?